When buying a home, we often overlook things that we realize later were actually very important to take into consideration.

After talking to some of our followers, we would like to share with you their thoughts and insights.

Zoning

I didn’t realize how important zoning is when buying a house. Due to zoning, after buying our home, we found out that we couldn’t build the way we were hoping to. We learned the hard way how important it is to speak to an architect or expeditor prior to buying if you plan on extending or building.

Professionals

Always ask a professional to check out each area and feature of the house, such as the heating/cooling system, the plumbing and electrical systems, the basement, attic, etc., so you know if any extra work needs to be done to bring the house up to move-in condition.

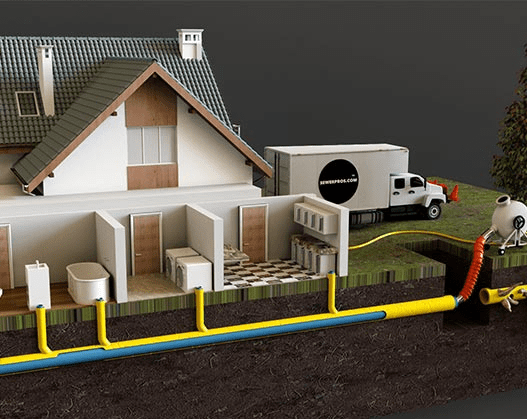

Sewer lines

Tell you what happened to me. Nobody advised me to run a camera down my sewer main line. The home inspector did not mention it, so it wasn’t done. He simply put on all the sinks and if the water went down, he said it was fine. The week I moved in, the bathtubs started backing up and the plumber comes over and says the sewer mainline collapsed. It cost me $12,000 to replace it. The plumber said had I ran a camera inspection prior to closing on the house, he would have seen it right away. We would have been able to negotiate with the seller for a lower price, or to replace the sewer main line. So, make sure you have the sewer main inspected with a camera by a professional plumber, and make sure to sign up for sewer main insurance from the water company (which also nobody advised me to do). Live and learn, I guess.

From the Desk of Arye Brecher

Why You Should Get That Mortgage Now…

Now is the time. During turbulent times, as we have had in the recent past, there is so much uncertainty at each turn. People worry: what will happen to the stock market? Will interest rates keep climbing? It brings back memories of the onset of COVID-19. Banks were scared about a crash and started raising rates and pulling mortgage products from the market. Experts were warning not to buy real estate because prices would plummet 50-60 percent. And all that talk was nothing but hot air. It didn’t turn out that way at all.

Now I’m not saying that we’ll wake up tomorrow and see the rates to be back at three percent, but now might be a great time to buy a home! Keep in mind, I am not an analyst or predictor of the future. However, I have seen dozens of buyers get priced out of the home buying market because prices were rising so quickly and sharply, and sellers were starting to only take cash offers. When there is fear in the market, buyers may feel pressured to grab up a deal and close on a house.

Interest rates have risen sharply, and this does really affect monthly payments. However, let’s be honest, the average home buyer barely holds a mortgage for five years. Whether selling or refinancing, mortgages get paid off. The reason why rates have popped is due to inflation running rampant.

Inflation means that money is easy to obtain. When anything is easy to obtain, its price goes down in value. When the dollar goes down in value you need more of it to pay for daily items. One of the main tools the Federal Reserve uses to tame the rate of inflation is by making money harder to get by raising interest rates. This makes it so that there is less money circulating and its value will increase again. They’ll hit a point where the economy will contract, and they’ll have to lower rates to give the economy another kick. When that happens, refinance your mortgage, and lower your monthly payments. Obviously, you have to be smart about your decision and not go into a payment that you cannot afford.

Do your research. Put in your offer. Make those dreams a reality.